Frequently asked questions

What’s the first step in getting started?

Getting started with Quantum Equity Solutions is quick and straightforward. Simply reach out to us with some basic details about your deal — such as the property address, purchase price, and construction budget (if applicable).

Once we receive your information, our team will contact you right away to discuss your options and next steps.

What is the general process from start to finish?

After reviewing your deal, we typically issue a term sheet within the same day. From there, we’ll collect a few simple diligence items like your photo ID, entity documents, and property insurance.

Our legal partners will then prepare the loan documents, and once everything is signed, your deal will be funded — often within days.

What if the property isn’t under contract yet?

No problem! We’re happy to provide preliminary feedback on your deal or issue a proof of funds letter to help you secure your property and compete with other cash buyers.

What documentation is required?

We keep documentation minimal to make the process easy. Generally, we’ll need:

Photo ID

Entity formation documents

Property insurance

Purchase and sale agreement (if applicable)

Construction budget (if applicable)

Do I need to provide bank statements, W-2s, or tax returns?

No. We don’t require bank statements, W-2s, or tax returns. Our process is designed to be fast, simple, and investor-friendly.

How does property insurance work?

We’ll provide our standard insurance requirements, which most brokers can easily accommodate. You can forward them to your insurance provider, or we can recommend trusted insurance professionals to help you meet the requirements quickly.

Is there a minimum credit score or income requirement?

No, we do not have minimum credit or income requirements. However, borrowers with stronger credit profiles may qualify for higher Loan-to-Value (LTV) ratios in select states.

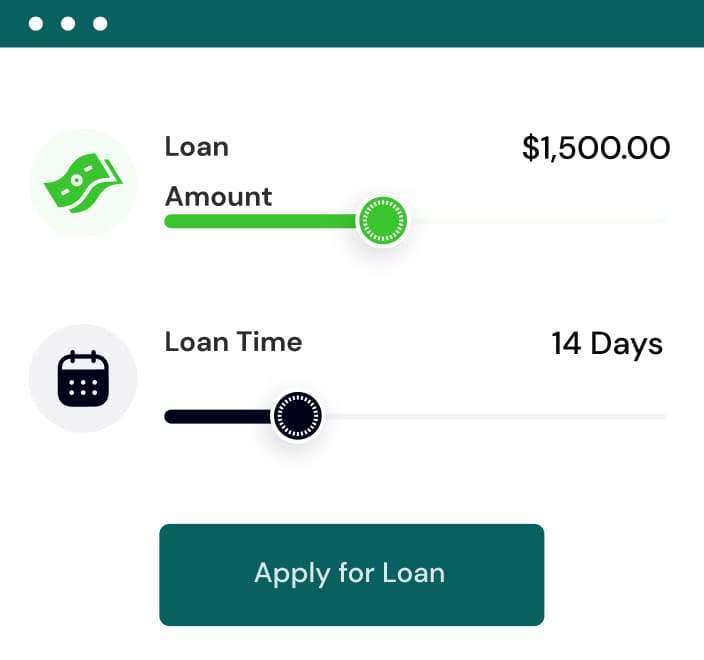

How are loan payments made and how often?

Payments are due on the first of each month. You can set up automatic ACH payments (recommended) or submit payments manually. We’ll provide full instructions for whichever method you prefer.

Will I receive loan statements?

Yes. You’ll receive monthly statements automatically, and they’ll also be available anytime through your borrower portal. If applicable, we’ll also send out annual Form 1098s electronically.

How can I track my loan and documents?

Quantum Equity Solutions offers an easy-to-use borrower portal where you can access your loan details, documents, statements, and payment history 24/7.

How are construction draws handled?

Construction draws can be requested via the borrower portal, email, or phone. Once an inspection is completed, we typically receive the report within 24 hours and issue your draw directly to your bank account.

Why does Quantum require minimal documentation?

Because we value speed, flexibility, and simplicity. As a privately funded lender, we make our own lending decisions — not Wall Street’s. That allows us to move quickly and keep your process hassle-free.

Why choose Quantum Equity Solutions over a bank?

Banks take weeks — we close in days.

We don’t have strict FICO or income requirements, and our in-house decision-making gives us the flexibility to fund deals that traditional lenders simply can’t. We focus on your property’s potential, not your paperwork.

How is Quantum Equity Solutions different from other private lenders?

We’re known for our speed, transparency, and consistency. Our clients value that we close on time, communicate clearly, and tailor every deal to fit their goals. It’s why many of our borrowers return to us again and again.

Where does Quantum Equity Solutions lend?

Nationwide

What property types and loan programs do you offer?

Quantum Equity Solutions offers a range of programs designed for real estate investors, including:

Fix & Flip Loans

Bridge Loans

Rental Property Loans

Construction Loans

Cash-Out Refinancing

For details on terms, rates, and LTV options, visit our [Loan Programs] page.

Ready to move forward?

Get Funded Fast

Submit your loan request today and experience the difference of a private lending partner that values speed, transparency, and personal service.